For CFOs evaluating the role innovation will play in their organizations, an examination of the automotive industry’s working capital structure can provide a useful frame of reference.

Alongside the auto industry’s push for technology and innovation, manufacturers appear willing to trade current profit and working capital performance for output. Despite increased sales and revenues, the structure of their working capital, as highlighted in the most recent Hackett Working Capital Survey, is battling unprecedented regulation from federal agencies, low consumer buy-in on electric vehicles and the impact of interest rates on consumers.

This situation regarding worsening profitability and working capital has many companies, including some of the most impactful representations of American culture, business and history, now operating like startups.

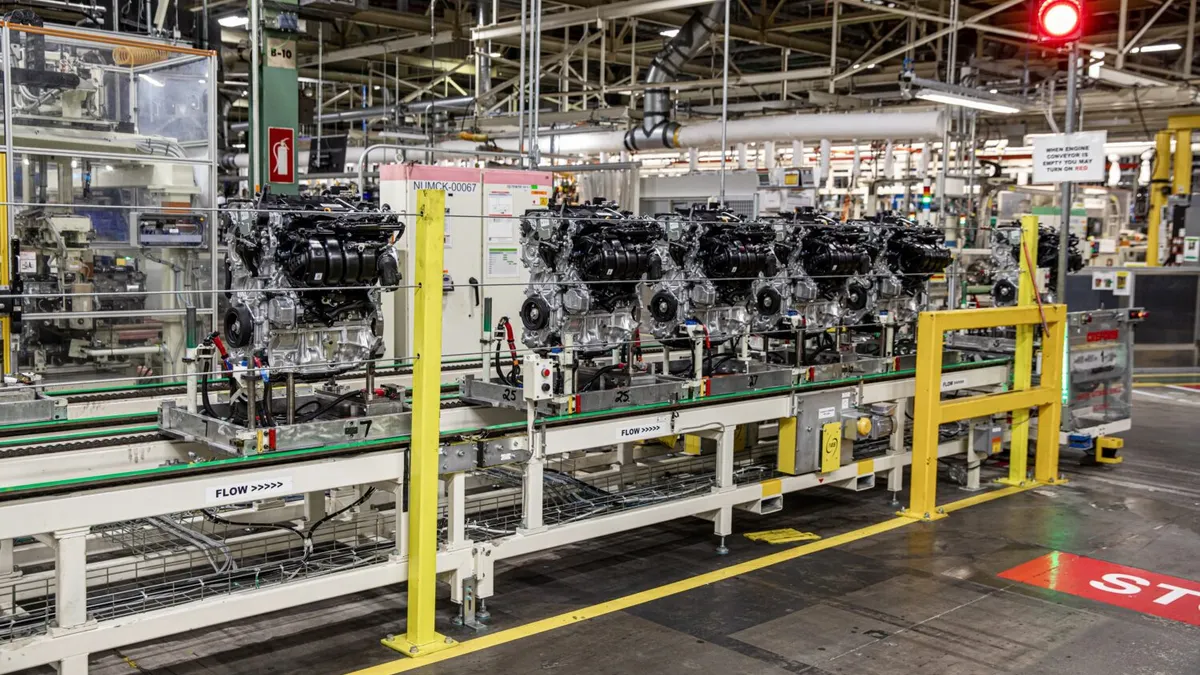

Inventory issues and DPO

For many manufacturers, inventory issues are the main problem, coming partly at the expense of their cash conversion cycle (CCC) and days payable outstanding (DPO), which are up 197% and down 15%, respectively.

“We've seen some pretty significant growth, and then the cost of goods sold was also higher than the revenue growth, so what we've seen would relate more to the startup type of working capital structure," said James Ancius, director at the Hackett Group. "We say this because they’re still experiencing some pretty good growth... but it’s all happening while their costs are getting higher."

Ancius highlighted inventory issues, a major problem for automakers since the pandemic, having too many or too few models at certain points. Although many automakers have addressed this problem, elements of their working capital structure have taken a hit, he said.

“Inventory has been degrading for four straight years — until this year, which was the first year of improvement where they’re starting to get caught up,” he said. “But it was nothing compared to what we’ve seen in terms of the cost of goods sold, and what really stood out to us here was the [15%] degradation of DPO."

The data shows seasonal changes and worker strikes, such as the one from September 15 through October 30, 2023, significantly impacted two major manufacturers — Ford and GM. These disruptions led to an accumulation of inventory parts containing rare earth metals.

Is ‘sustainability’ financially sustainable?

New auto technologies have become standard over recent years. This standard has required companies to reinvest a significant amount of their revenues into the development of these technologies for the sake of competition and affordability.

Zach Shefska, CEO of CarEdge, built a social media-inspired consumer-guiding car-buying business with his father and has a tremendous following on YouTube and TikTok. Shefska notes that regulators pushing tech-inspired standards in new cars are driving up vehicle costs and creating a new financial challenge for manufacturers.

“The rising cost of mass-market vehicles is 100% being driven by safety and regulatory standards from the federal government,” said Shefska. “In higher-end manufacturers like BMW and Lexus, sure, innovative technologies are driving up the cost there, but in your mass-market vehicles, it’s your local and federal government doing that.”

When it comes to the investment in electric vehicle production, Ancius said this has created new competition that is driving innovation in electric vehicle battery development. According to him, competition in this space, especially regarding pricing, is starting to play a more significant role but has yet to remedy the growing losses that come with electric vehicle production.

“What automakers are starting to get into with battery development are these offtake agreements where they're obligated to purchase a fixed amount or percentage of what's been produced by those suppliers, to ensure that they have the supply to keep creating and innovating these newer vehicles,” Ancius said.

For some companies, these offtake agreements were responsible for 25% of the increased inventory. Despite an 11% increase in inventory, days inventory outstanding (DIO) improved since the cost of goods sold (COGS) increased by 17%, surpassing the inventory growth.

“You've got two of the largest, probably most well-established U.S. car manufacturers caught a little bit on the back foot,” Ancius said. “And now they’re struggling in terms of working capital and running at some fairly large losses in their electric vehicle and hybrid units.”

However, according to Shefska, the continuation of these innovations will be heavily impacted by the political makeup of the U.S. government and regulators in the future. He said all signs point to automakers pumping the brakes on EV investment and production.

“A lot of the idea of the continuation of the electric vehicle push hinges on who is going to be President,” said Shefska. “But, if you take that part of the equation out, it’s very clear to me that things are going to slow down in this area.

"There are upwards of $15,000 in tax incentives in some states for these vehicles, and sales are beginning to stall out,” Shefska continued. “General Motors is starting to pull out of their EV ambitions and even the UAW is starting to get nervous because of the amount of effort that went into the negotiations last year between them and the legacy automakers regarding battery and electric vehicle production; the writing is on the wall.”

EV profitability and macroeconomic impacts

Shefska believes the way Tesla has disrupted the automotive industry has created this financial situation. As he notes, the only companies making any money selling electric vehicles are Tesla and those based in China. Recent reports suggest Ford, for example, is losing nearly $132,000 per electric vehicle sold. “All of these [traditional] automakers are in the same ballpark of loss,” Shefska said.

“I think the biggest thing driving this [working capital structure] is Tesla,” said Shefska. “If you look at Tesla’s impact and their valuation, a lot of that money is going into the original equipment manufacturer (OEM) level. Ford set up a whole new division for electric vehicles, with a heavy focus on the EV powertrain, but that doesn’t make them any money.”

Ancius agrees the government will have an impact, but he says that macroeconomic factors like regulation and other rising costs will affect the affordability of new vehicles on this current trajectory.

“I think an important macroeconomic factor is the government crackdown on traditional automaking or government regulation on it. That will kind of help shape this industry as well as push and incentivize consumers,” Ancius said. “Materials are more expensive. So the cost of vehicles has gone up pretty significantly over the past few years, I would argue, so I can’t help but wonder at what point does it also just get almost too expensive for the consumer?”

According to Shefska, the most important macroeconomic factor impacting automakers at the moment is interest rates. These are not only resulting in repossessions from dealerships and customers alike, but this combined with a market of rising auto insurance premiums across the country and vehicles financed over MSRP during post-pandemic inventory shortages is creating an unprecedented situation for the consumer market.

“I just tweeted this out today; my DMs are flooded with people telling me they are upside down $20,000 on their vehicles,” Shefska said. “I think there is a developing negative equity crisis among consumers, which can result in dealership inventory buildup if consumers aren’t able to trade in their vehicles. We are also seeing a ton of vehicles repossessed at the dealer level; brand new cars being repossessed by manufacturers themselves and sending those vehicles to auction.”