Automakers must partner with suppliers, regulators and other stakeholders to develop software-defined vehicles and vehicle connectivity, according to a September report from Deloitte.

Such investments require the expertise of companies that traditionally work outside the automotive industry, including software development and artificial intelligence. They also need over-the-air updates to ensure software and services stay up-to-date, but most automakers’ vehicles lack the technology, with the notable exception of Tesla.

Adding value to software-based vehicles

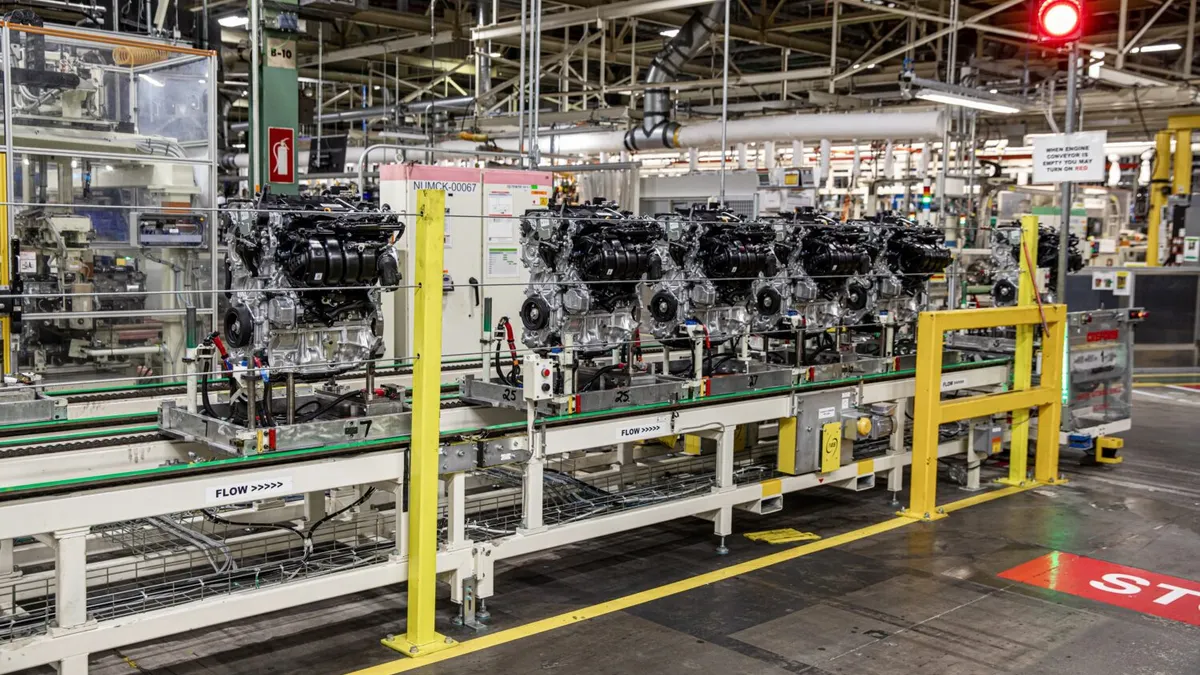

As cars become more like smartphones on wheels, automakers need to move away from their long-established, hardware-centric approach to vehicle production, the report says. Software-defined vehicles could significantly increase the value of automakers’ products, but they are far more complex than the cars and trucks automakers have produced historically. But adding software to vehicles can also make them more appealing, according to Deloitte.

For example, features that recognize when a driver approaches a vehicle to unlock it and automatically adjust the driver seat, mirrors, lighting, temperature and audio systems to a driver's favorite presets rely on complex integrated software.

This software-based approach to vehicle development could also improve vehicle manufacturing, such as implementing increasing quality improvements via real-time engineering feedback that can help automakers avoid expensive warranty claims.

Software can also allow automakers to offer in-vehicle subscriptions to generate new revenue streams.

According to Deloitte, automakers can charge up to $900 a year for access to these new services, such as purchasing a software subscription that can unlock more power for quicker acceleration. However, software-based vehicles that support over-the-air updates will require scalable hardware and software to enable maximum value creation throughout their service life,.

Therefore, closer collaboration between OEMs, traditional suppliers and tech companies can be highly beneficial. For example, companies can leverage their strengths and resources to develop and deploy new vehicle technologies more quickly and efficiently as the market expands.

The automotive software market is expected to grow from $3.3 billion in 2022 to nearly $14 billion by 2030, the report says. The penetration of software-defined vehicles is poised for exponential growth, from 2.4% of all vehicles in 2021 to 90% or more by 2029.

Building a software ecosystem for vehicles

Automotive OEMs that have relied upon their engineering departments to decide what is best for customers should be working more closely with third parties that have more expertise in software and other connected digital services, according to the report. At the same time, offering customers a better mobility experience relies on a large software ecosystem to be in place, which does not exist yet for most automakers, with the exception of Tesla.

One example of this is to develop a digital marketplace or vehicle “app store” where customers can add new features to their vehicles, according to Deloitte. However, automakers typically have far less expertise in software than tech companies and third-party software developers.

Working with industry partners allows customers to decide what’s best for their vehicles, rather than OEM engineering departments. It will also help automakers develop more varied software products for their model lineups.

In the near future, adding or improving vehicle features, especially for electric vehicles, will be done via over-the-air software updates. These may include performance upgrades, security feature updates or adding personalized apps. By working with tech companies, OEMs and traditional suppliers can develop expanded business models and digital services to capitalize on these new opportunities, according to the report. But automakers will need strong partners to create such vehicle platforms.

Accommodating customer preferences by supporting popular software

GM recently announced plans to drop native support for Apple CarPlay and Android Auto. Instead of native support for these services, which includes Google Maps, the automaker is building its own infotainment OS that can integrate with them.

GM said it will offer a built-in Google-powered infotainment experience on its future EVs that offers Google Maps, Google Assistant and music streaming service Spotify. The decision could face scrutiny because most drivers find the ability to mirror or sync their smartphone to their vehicle infotainment screen to be highly useful. GM will stop offering CarPlay and Android Auto beginning with the 2024 Chevrolet Blazer EV, according to the Detroit News.

Ford, however, is sticking to its plans to integrate popular third-party apps and services in its vehicle infotainment systems. In a video interview with the Wall Street Journal in May, Ford CEO Jim Farley said the company will continue to offer Apple CarPlay after GM’s decision not to include it in future vehicles.

“Seventy percent of our Ford customers in the U.S. are Apple customers,” Farley told the Wall Street Journal. “Why would I go to an Apple customer and say ‘good luck’?”

Farley also admitted to the Wall Street Journal that Ford has already lost the digital content battle with companies like Apple, so its future vehicle software platforms will instead be centered around safety, security, automated driving features and productivity.

These advanced driver assist systems and automated driving features that increase vehicle and road safety will likely be the most demanding applications for automakers to develop. It will require deep business, regulatory and technology expertise. However, these new types of collaborations could be beneficial to gain speed to market and share development costs.

Managing the data that connected and software-based vehicles will generate

As the era of software-defined vehicles quickly approaches, another important requirement of automakers will be managing all of the data their connected and software-based vehicles will generate. In 2022, the amount of connected vehicle data totaled 20 exabytes, and it is estimated to reach 117 exabytes by 2027, according to the report.

The data can be monetized in several ways, per Deloitte, including being anonymized and made available to urban planners, insurance providers, advertisers or logistic providers.

For automakers, however, collecting vehicle and personal data raises privacy and cybersecurity issues. So regulations addressing these concerns will have to be developed by collaborating with a variety of industry stakeholders and regulators.

But working with third parties may present additional challenges for automakers that may need to be addressed, including control of intellectual property, source code transparency and data ownership. In addition, tech companies working directly with automakers may want to retain control over the software and data they develop, while OEMs may want to have control over the data their future vehicles generate.