In its recent report on the state of the global critical mineral market, the International Energy Agency makes one thing abundantly clear — high demand is here to stay.

As countries like the U.S. make agressive pushes to transition their economies to clean energy, demand and prices for the critical minerals needed to power that change have risen.

Between 2017 and 2022, global demand for lithium tripled, while demand for cobalt jumped 70% and nickel demand climbed by 40%, according to the international energy policy organization’s market review. Prices, meanwhile, continue to "remain well above historical averages."

Both the public and private sector have made aggressive moves to take control of mineral supply chains in recent years. The U.S. is awarding tens of millions of dollars in funds to grow domestic mineral supply chains and passed the Inflation Reduction Act to encourage companies to invest in and grow their clean energy production.

Industry players like automakers GM and Ford are taking active roles in their mineral supply chains through investments and joint ventures in mining and refining.

Despite these efforts, the skyrocketing demand for critical minerals has raised concerns over whether the global supply of materials including lithium, cobalt and nickel can keep up.

The IEA highlights three three key questions around the future of global critical mineral supply:

- Can future supplies keep up with growing demand before the market reaches a mismatch?

- Can mineral supplies come from diversified sources?

- Can minerals be supplied from clean and responsible sources?

The market has shown progress in raising battery-grade supply, according to IEA. Global investment in critical mineral development rose again in 2022, up 30% compared to 2021, led by a 50% increase in lithium development.

Similarly, global spending on exploration, which is the process of determining where minerals exist and can be extracted from the ground, was up 20% last year, led by Canada and Australia.

The spending and action on sourcing critical minerals buoyed the IEA's optimism around whether the world can meet the ambitious goals countries have set for a green energy transition.

"We have seen that increase in capital expenditure, and naturally enough that produces an increase in anticipated supply," IEA Chief Economist Tim Gould said during a presentation Tuesday on the report.

Geographic distribution of planned refining projects, 2023-2030

When it comes to diversification however, the agency is less confident.

Despite provisions in the Inflation Reduction Act that push battery and automakers to source raw materials from countries outside places like China, critical supply remains controlled by a select few countries. Chile, China and Australia control the vast majority of lithium, while Indonesia and the Democratic Republic of Congo respectively dominate nickel and cobalt supply.

In comparison, the U.S. holds just 3.6% of global lithium reserves and .7% of global nickel supply.

Planned projects for new mineral supply aren't much more diverse – China controls half of the world's planned lithium chemical facilities, while Indonesia makes up 90% of planned refined nickel plants.

And while companies like GM and Ford are investing in lithium and nickel mines to take supply chain control into their own hands, efforts by individual companies lag far behind powerhouses like China, making it hard for agencies like IEA to see a clear path to success when it comes to supply diversification.

Finally, the IEA is skeptical about the global ability to develop a clean and responsible critical mineral supply chain.

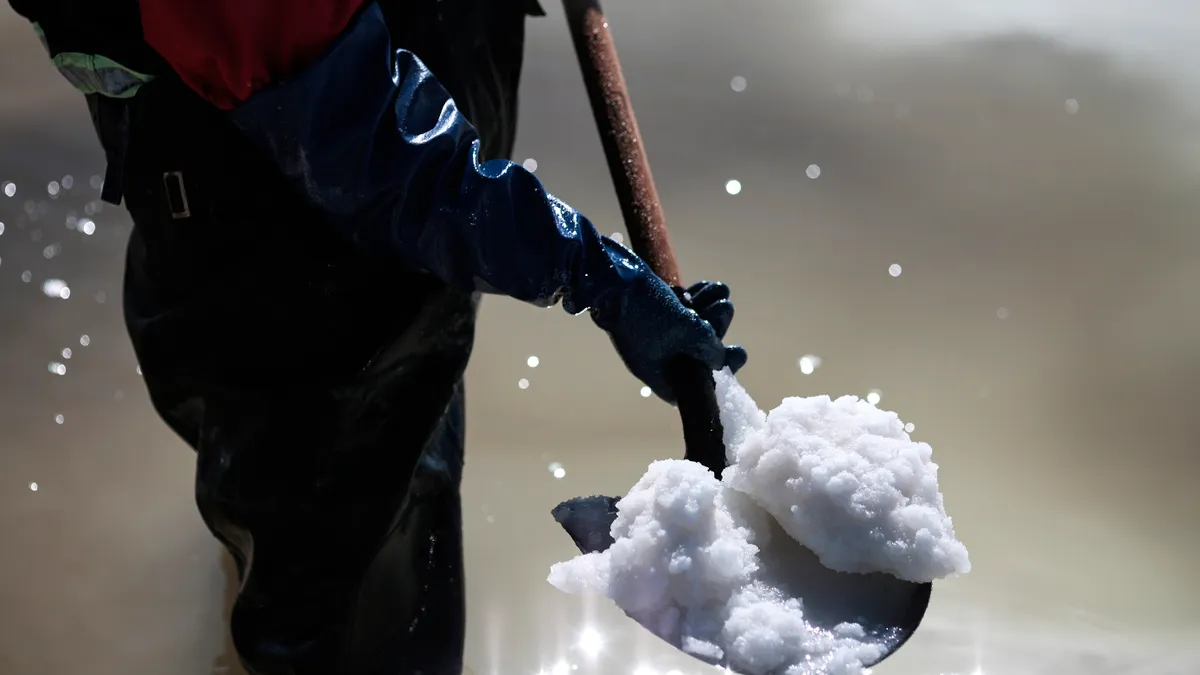

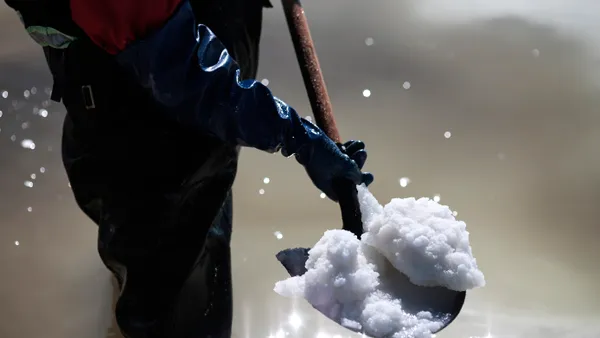

While some in the industry have made headway on gender balance, community investment and worker safety, environmental indicators have not improved at the same rate.

Carbon emissions and water use at mining and refinery production sites remain high, with less interest from both companies and consumers to change this status quo with different processes and cleaner investments.

"This is an area where consumers can also play their part," Gould said. "If they demand high standards in their sourcing and investment decisions, that provides a strong impetus for producers to act and improve their performance.”