Dive Brief:

- New vehicle affordability improved in September for the first time since 2019, according to the Cox Automotive/Moody’s Analytics Vehicle Affordability Index released Oct. 16.

- The estimated average monthly payment dropped from $771 in August to $765 in September, a 0.8% decline, after peaking at $794 in December.

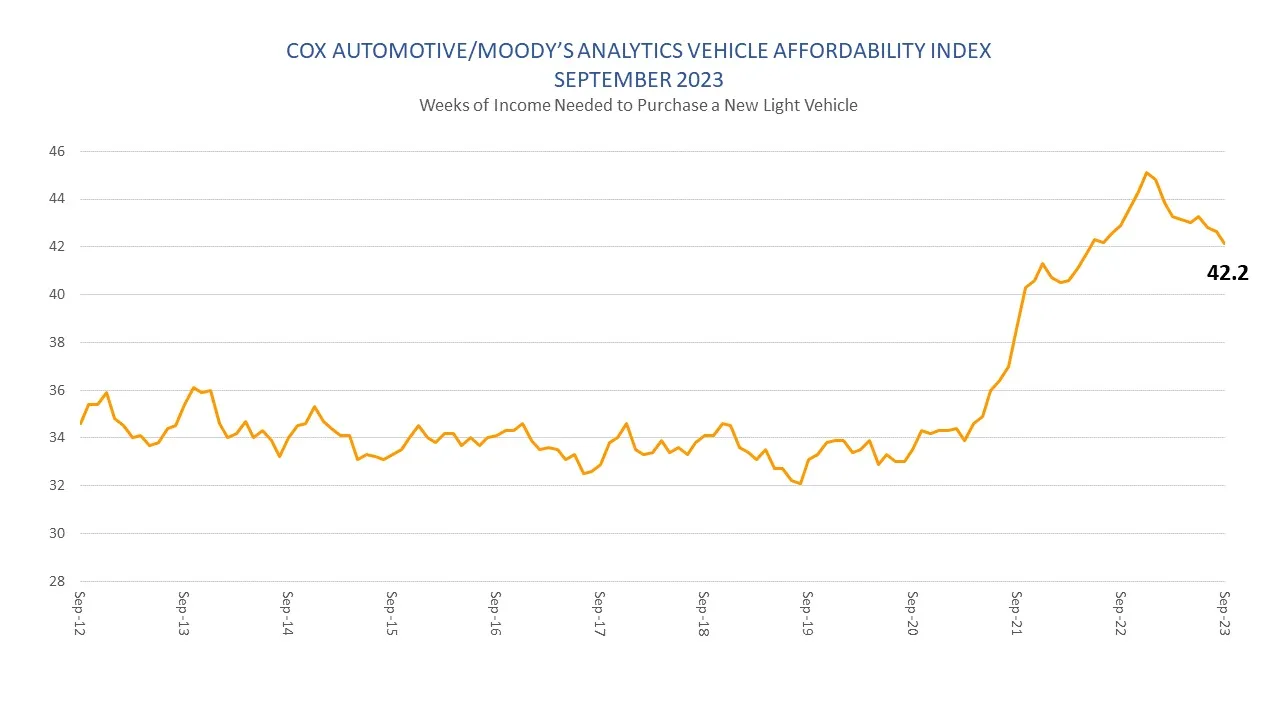

- The median number of weeks of income required to purchase a new vehicle fell from 42.6 weeks to 42.2 weeks from August to September. That figure declined 1.6% year-over-year from 42.9 weeks in September 2022.

Dive Insight:

While interest rates on new car loans jumped to a new high of 10.48% and are 2.5% higher than in September 2022, Cox said sizable income growth — 0.3% month-over-month — and lower car prices helped make vehicles more affordable for new car shoppers.

More affordable vehicles may help automakers sell more cars and trucks, as consumers have taken out fewer auto loans due to higher interest rates. The Federal Reserve has raised rates to tame inflation, but as core inflation declines, the Fed could lower rates, which may bolster new car sales.

Higher dealer inventory levels and bigger incentives have also helped keep new vehicle prices in check, Cox said last month, although incentives remained flat from August to September.

The average transaction prices for new vehicles fell from $48,259 in September 2022 to $47,899 last month, a 0.5% YoY decline. Electric vehicles are also getting cheaper, driven mainly by Tesla’s price cuts, which lowered the automaker’s prices about 25% YoY.