“Drill baby, drill,” President Donald Trump stated during his March 4 address to Congress, announcing his efforts to extract more oil domestically. That marked a sharp change from the Biden administration’s climate policies that sought to reduce the use of fossil fuels.

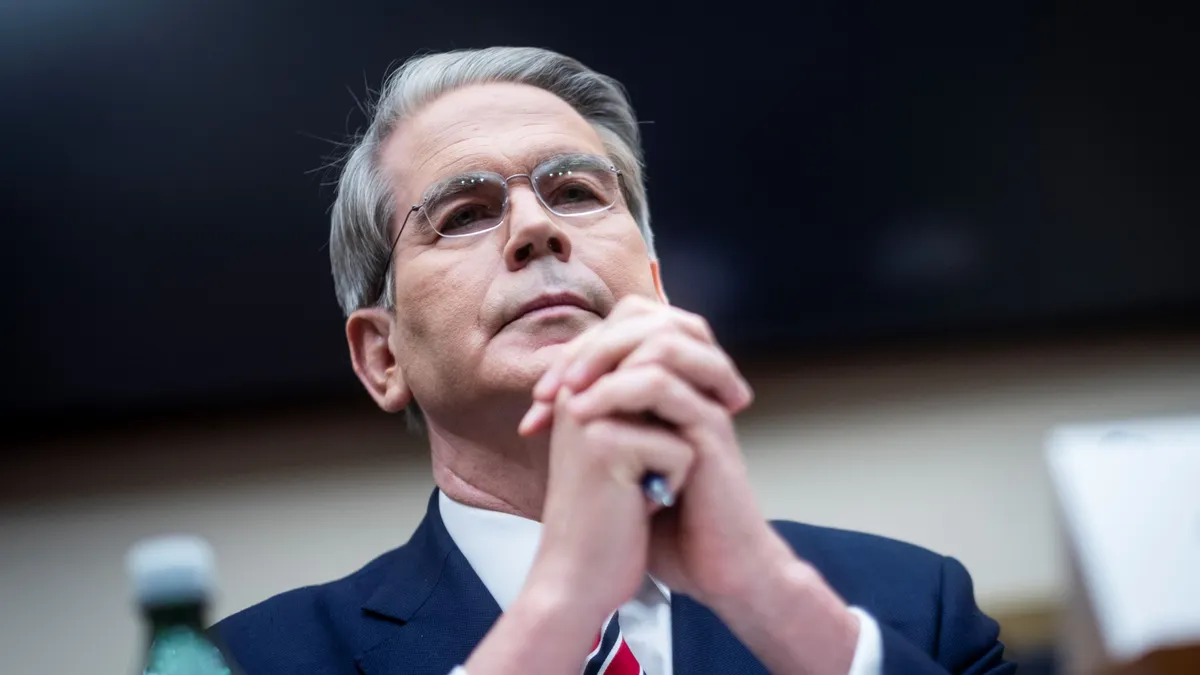

The Trump administration’s desire to produce more oil could improve supply and provide some additional short-term breathing room for c-stores that weathered high prices not long ago, said John Eichberger, executive director at the Transportation Energy Institute.

“That should drive prices down, which would boost margins, at least temporarily,” said Eichberger.

But those policies are unlikely to dramatically increase oil production — and there are a number of competing factors that could determine the gas price landscape over the next year, experts say. These include more fuel-efficient cars on the road, continued momentum for electric vehicles, the impact of Trump’s tariff policies and international developments, such as the ongoing war in Ukraine.

“We’re not going to see a flood of oil hitting the market and new wells popping up in your backyard overnight. We’re not going to see electric vehicle sales disappear,” said Eichberger. “We’re not going to see that rapid transformation of the market in a short period of time.”

But the Trump administration is trying to boost that timeline. It’s rolling back a number of Biden administration rules aimed at reducing greenhouse gas emissions from vehicles and pushing automakers to produce EVs.

Gas prices surged in 2022 as Americans returned from Covid-19 pandemic lockdowns. But lately, gas profit margins have been consistently healthy, said Anthony Bonadio, a convenience store research analyst at Wells Fargo Corporate & Investment Banking.

“I’d say things have kind of stabilized,” Bonadio said. “This has been as normal an environment as we’ve seen in a while.”

Fuel prices continue to moderate

Over the past five years, retailer gross margins have averaged 27.2 cents per gallon, or 10.7% of the overall price, which has prompted store operators to try and boost profits by growing their in-store sales of food and beverages, according to NACS.

But gas demand has increased over the past few years, said Jeff Lenard, NACS’s vice president of media and strategic communications. The demand for gasoline in the U.S. is expected to reach 9 million barrels per day in 2025 — nearing the record of 9.3 million set in 2018, according to NACS data.

The U.S. Energy Information Administration in January forecasted a small increase in U.S. gas consumption in 2025, followed by decreases in 2026 due to rising vehicle fleet efficiency attributed to EV purchases and increasing fuel economy in cars with conventional internal combustion engines.

Wells Fargo data found that by the start of 2025, gas prices had fallen by about 29% from their peak at $4.92 per gallon in 2022, according to Bonadio.

Those prices are still decreasing. AAA reported on March 6 that in the previous week, the national average price for a gallon of gas was $3.11 — two cents lower than the month prior and 27 cents lower than a year ago.

But some drivers could see fluctuations at the gas pump due to retailers and markets reacting to the tariffs and the transition to summer-grade gasoline, according to AAA’s report.

Predicting future prices

Trends in miles driven, population growth in certain areas and whether people become more mobile could contribute to gallon consumption and potentially affect sales, said Bonadio.

Many c-store retailers, said Lenard, also made plans for EVs based on federal funding for charging infrastructure that was included in the Biden administration’s Bipartisan Infrastructure Law — a program the Trump administration paused funding for. This may slow the rollout of EV infrastructure in some areas and keep more drivers in gas-powered vehicles.

However, Eichberger also believes the demand for EVs is still growing and won’t be tempered by federal policies implemented under the Trump administration.

Case in point: EVs accounted for 8.1% of vehicle sales in 2024, up from 7.8% of all sales in 2023, a Cox Automotive analysis found. EVs represent less than 2% of all vehicles in operation nationally — with the highest rate in California at 2.5%, said Eichberger.

Instead, improvements in vehicle fuel efficiency that were implemented to meet standards set in 2011 by the Obama administration have had a bigger impact on fuel use, said Eichberger. Average fuel economy in the U.S. rose over 35% from 2002 to 2022, according to a Lending Tree study, and federal standards continue to rise.

Trade policies and international events could also play a role in prices.

The Trump administration has been involved in an escalating trade war with Canada and the European Union, after announcing, lifting, and re-implementing tariffs on its neighbors to the north and Mexico. Last week, another raft of tariffs rattled oil markets again.

It's uncertain how those tariffs will play out in the fuel industry, said Lenard. In 2024, the U.S. imported roughly 4.5 million barrels of petroleum per day from Canada — accounting for roughly 60% of its total crude oil imports. In 2022, the U.S. imported 733,000 barrels of crude oil per day from Mexico.

“Tariffs, whether they are at 10%, whether they are at 25%, whether they’re on oil or refined products, could have an impact on issues related to supply and demand,” said Lenard. “It’s up in the air how those will play out.”

The increased drilling Trump is calling for could offset some impacts caused by the tariffs, said Bonadio. And there are indications that OPEC+ will increase oil production in 2025.

Tariffs are creating a lot of volatility in the crude market, which affect gas prices and profit margins, said Bonadio. A potential resolution to the ongoing war in Ukraine could play a factor as well, he said.

“Volatility is clearly a lot higher this year than it has in a while,” said Bonadio. Still, “I think there’s a reasonable case to think there is a scenario where they’re reducing gas prices.”