EVs could drive a 38% rise in U.S. electricity consumption by 2050, according to National Renewable Energy Laboratory estimates. The demand will provide utilities with new revenues, but it will also require distribution system upgrades and load management strategies to ensure charging vehicles help maintain grid reliability rather than overload local electricity systems, experts say.

To understand where to make grid upgrades, when to purchase more renewable energy and how to ensure customer satisfaction doesn’t suffer, utilities increasingly are working with a variety of participants in the automotive sector, including vehicle manufacturers, car dealerships and ride-hailing services.

“Because we don't make the cars, and we don't sell the cars, we know partnerships are absolutely critical,” said Nadia El Mallakh, Xcel Energy’s vice president of clean transportation and strategic partnerships.

“These are two groups of people that never had to interact before the dawn of EVs,” said Joel Levin, executive director of Plug In America. Automakers and utilities “are now partners until the end of time, whether they like it or not,” he said. Decisions made by automakers “have a huge impact on utilities, and vice versa.”

“We've seen an uptick in joint ventures across the board,” said Leilani Gonzalez, policy director for the Zero Emission Transportation Association. “Utilities are in a space where they're looking to decarbonize, and this is the pathway forward. They’re making sure we have a modern grid to handle the load fluctuations.”

To better understand how utilities are working with the automotive sector, Utility Dive has developed a tracker of partnerships and spoke with five utilities about their particular work. The partnerships span a range of subjects that include managed charging, vehicle-to-grid integration, matching demand to renewables supply and ensuring customers have a smooth transition to electric transportation.

PG&E, BMW expand partnership to explore V2X

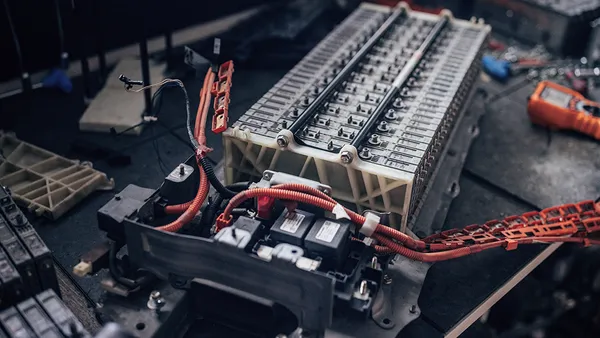

EVs constitute about 7% of new vehicle sales today, but growing consumer interest and state and federal standards are expected to drive rapid adoption. President Joe Biden wants EVs to make up 50% of new vehicle sales by 2030. That means utilities will face a steep ramp in electricity demand for transportation, with higher peak loads potentially causing reliability issues.

“From a utility perspective, you want charging to be kind of smooth, not with big peaks,” Levin said. But automakers are building more powerful EVs with larger batteries and faster potential charging. A Level 2 home charger can draw up to 19 kW, meaning a few electric vehicles on the same block can turn into “a big surge in demand” if not effectively managed, he said.

Pacific Gas & Electric began partnering with BMW in 2015 on a smart-charging pilot with “some really basic functionality,” said Adam Langton, energy services manager at BMW of North America Group.

“We need these kinds of partnerships for this to work."

Amy Costadone

Principal product manager for Pacific Gas and Electric.

“We started with demand response events where we're just curtailing [vehicle charging], and then we started doing more complex things where we're actually looking at the impact on local distribution by simulating scenarios where we were testing how vehicles respond to a signal in a specific a neighborhood,” Langton said.

In May, the two companies announced they would expand their partnership to also study an EV’s potential to send power back to the electric grid or to power a home or other building. Interest in vehicle-to-everything technologies, known as V2X, is growing as utilities see EVs as something akin to mobile distributed energy resources.

“We need these kinds of partnerships for this to work,” said Amy Costadone, principal product manager for PG&E. The utility is also working with Ford and General Motors on bidirectional charging.

The research partnerships are “critical” for EVs to be used as grid assets, Costadone said. “We need everyone to win if we want this to be scalable, and not just for one EV” manufacturer, she said.

BMW and PG&E plan to test vehicle-to-grid applications in a field trial at a BMW facility in Mountain View, California, and other V2X applications at PG&E’s Applied Technology Services Lab in San Ramon.

“We usually keep our expenses separate and work on different activities,” Langton said.

“We need to understand how the customers really want to use this,” Costadone said. “I feel good about the partnerships that we have and that the technology will get there. The engineering is possible to make this a reality.”

Consolidated Edison tests new technology with GM Energy, others

In New York City, Consolidated Edison has several partnerships allowing it to test and implement new equipment connecting EVs to the grid. In October, the utility announced it would work with GM Energy, a new energy management unit of General Motors, to test how EV chargers can track energy use and charging behavior without the need for a separate meter.

“It’s more of an arrangement of convenience,” said Joe Morreale, ConEd’s section manager for EV demonstration projects and managed charging. “Both parties have things they want to learn and test and experiment with that they can't do on their own.”

ConEd wants to learn more about GM hardware to “get a sense of what it's capable of, how it might function as a distributed energy resource,” he said. And the partnership provides GM with access to testing data and real-world grid conditions.

“Both parties have things they want to learn and test and experiment with that they can't do on their own.”

Joe Morreale

Consolidated Edison's section manager for EV demonstration projects and managed charging.

“It's really an opportunity for both parties to learn from the other's expertise and develop products that are tailored for the benefit of their end customers,” Morreale said.

ConEd has also partnered with the FLO charging network and the city of New York to install curbside chargers and study how they’re used and how public charging can advance EV adoption in the nation’s most populous city. Whether public or private entities are involved in EV-related partnerships, the “grand scope is much the same,” Morreale said. “Both the utility and third party recognize that there are benefits to working together, sharing information, more than if each party goes about it separately.”

In the case of curbside charging, FLO has expertise with EV charging equipment while the city holds the franchise over the streets.

“And so the result is that we get to install hardware on a city street, which is not somewhere where we normally get to install,” Morreale said.

“It’s really a perfect union,” he said. The private business is supplying the technology while the city supplies “the laboratory” and the utility brings data, program administration and execution. “That's just not something you can do unilaterally, and we're really happy with the results so far,” he said.

Dominion maintains close ties with electric bus dealership

Dominion Energy has multiple partnerships in the EV space, but the “largest and most fully implemented” is its electric school bus program and its work with dealership Sonny Merryman, said Kate Staples, the utility’s director of electrification.

Dominion launched its program in 2019 with a competitive request for proposals, and it selected Sonny Merryman, a Virginia dealer of fleet transportation, to deliver 50 electric school buses beginning in 2020. Sonny Merryman also sells the necessary chargers to the school districts and assists in supporting the installation of those chargers, said Whitney Kopanko, EV program manager and marketing director at Sonny Merryman.

The program has two phases. In the first, Dominion installs, owns and maintains the charging infrastructure for the the school districts and also owns the battery on the school buses, Staples said.

Because electric buses are still more expensive than diesel, “we needed to provide a financial means of helping the school districts get over that hump,” Staples said. “So the school district pays for the traditional part of the bus and we pay for the increment, and so we own the battery.”

“At the end of our agreement with those school districts, we own the battery, we can take it out of the bus and we can use it as stationary storage,” she added.

The last of the 50 buses covered by Dominon’s initial RFP was sent out in 2021, but Sonny Merryman “continues to work very closely [with Dominion] on charger installation,” Kopanko said.

“We work together on actually designing [the site] and installing the chargers [with] our sales individuals, our service individuals, working with Dominion,” Kopanko said. There are site visits to discuss customer locations and needs and how the dealership and utility can support those aspirations.

“A lot of our fleet customers, historically, have been really intensive energy users. They are really complex electricity users."

Kate Staples

Dominion Energy’s director of electrification.

“A lot of our fleet customers, historically, have been really intensive energy users. They are really complex electricity users,” Staples said. As school districts switch to electric buses, “we want to make sure that we're strengthening our relationship with them and making sure that we deliver what they need from an electricity perspective,” she said.

“That's where the partnership with the dealership comes in and is really critical. Because the dealerships understand the needs of those customers,” said Staples. Sonny Merryman “has been instrumental in connecting the utility with the customer and making sure the customer has the education that they need.”

In Colorado, Xcel has a unique regulatory approach to EV partnerships

In Colorado, Xcel Energy makes use of a unique regulatory vehicle to move quickly on research pilots and partnerships, said El Mallakh. The Public Utilities Commission approved a portfolio for the utility that allows it to launch initiatives through a 60-day notice process.

“It's a $10 million program that supports partnerships, research and innovation in the EV ecosystem,” she said. The utility is running more than half a dozen partnerships through the portfolio and has proposed the same approach in Minnesota.

“It's like a mini filing. It's pretty simplified,” she said. The 60-day notice lays out the goal of the partnership, Xcel's investment and what the partner brings to the table.

In one of the projects, Xcel has partnered with Colorado CarShare to study how to reduce the upfront and operational costs of car-sharing services that support underserved communities.

Through the nearly $2.5 million initiative, Xcel will provide rebates to help make EV purchases more affordable for the program, perform the make-ready work for charging infrastructure and provide charging equipment for a variety of partners, including the Boulder County Housing Authority, the town of Breckenridge, Colorado Mountain College and the University of Colorado.

Peninsula Clean Energy turns to ride-sharing services for grid data

Energy providers that are not distribution system owners are also forging partnerships to handle EV growth.

Peninsula Clean Energy is a community choice aggregator operating in San Mateo County, California, with a goal of providing 100% clean energy by 2025. There are about 45,000 EVs in the county, and they are about 34% of new purchases, said Phillip Kobernick, PCE’s senior transportation program manager.

PG&E delivers the electricity, but under California’s CCA model the provider is tasked with ensuring the supply.

“The pressing issue for us is renewables alignment,” Kobernick said. “We want to be providing 100% renewable energy every hour of the day. And there's a couple of hours that are more challenging ... And having massive incoming DC fast-charging spikes happen at 5 p.m. or 6 p.m. on a daily basis will make that challenge harder.”

In 2021, PCE partnered with Flexdrive, an independently managed subsidiary of Lyft, to trade grid data for subsidized vehicle rentals. PCE is subsidizing the cost of 100 EVs that drivers can rent from Flexdrive, ensuring they are the same cost as a hybrid vehicle and providing free charging.

“It's meant to really convey a lot of benefits,” Kobernick said. “We wanted to learn what it looks like when you have EVs in these types of high-mileage services. How do drivers like them, how are they charging them, and what are the barriers to further expansion?”

Lyft published a mid-cycle assessment in a blog post in March, examining data from more than 213,000 rides covering more than 2.72 million miles. The subsidized EVs consumed a collective 3,000 kWh per day, on average, “saving an estimated 146 gallons of gas per day.”

PCE gets utilization data each month and load shape analysis less frequently. So far, it has identified problematic hours where delivering all clean energy to customers can be a challenge.

“We might want to explore alternatives to having folks doing mass fast charging during those hours,” Kobernick said. Alternatives could include incentives for off-peak charging or battery swapping, he said.

PCE is also working on a managed charging pilot targeting residential customers who charge at home. That work is being done in partnership with EV Energy, and the results ultimately will be shared with the University of California-Davis.

“We want to do our own analysis, but we also want to share it with academic partners who are interested in studying energy and economics and have them do their own independent analysis,” Kobernick said.